The One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, introduces many

tax benefits for small businesses and their owners. However, not all provisions are favorable.

Below are key planning strategies to consider before year-end to optimize your tax position.

1. Timing Strategies for Pass-Through Entities

Tip: Adjusting when you recognize income and expenses can help lower your tax liability.

Details: If you operate as a sole proprietor, single-member LLC, partnership, LLC taxed as a

partnership, or S corporation, your business income “passes through” to your personal return.

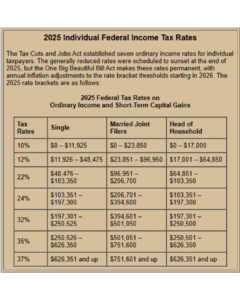

The OBBBA permanently extended the 2017 TCJA individual tax brackets (10%–37%, with

annual inflation adjustments).

If you expect the same or a lower tax rate in 2026:

o Defer taxable income into 2026.

o Accelerate deductible expenses into 2025.

If you expect a higher rate in 2026:

o Accelerate income into 2025.

o Defer deductible expenses into 2026.

This allows income to be taxed at lower rates and deductions to be used when they’re worth

more.

2. Qualified Business Income (QBI) Deduction

Tip: The OBBBA made the QBI deduction permanent, but eligibility rules still apply. Work with

your advisor to avoid missteps.

Details: Pass-through owners may deduct up to 20% of QBI, REIT dividends, and publicly

traded partnership income. Restrictions kick in when taxable income exceeds $197,300

($394,400 joint). These are fully phased in above $247,300 ($494,400 joint).

Starting in 2026: Phase-in thresholds rise to $75,000 ($150,000 joint), expanding

eligibility.

Specified service trades or businesses (SSTBs): Deduction phases out completely

above those limits.

Minimum deduction: Beginning in 2026, taxpayers with at least $1,000 of QBI and

material participation receive at least a $400 deduction (inflation-adjusted).

Planning note: Moves like large depreciation deductions or retirement contributions can

unintentionally reduce your QBI deduction.

3. Bonus Depreciation

Tip: Place eligible assets in service by year-end to maximize 100% first-year depreciation.

Details: The OBBBA restores permanent 100% bonus depreciation for assets placed in service

after January 19, 2025 (previously set to fall to 40%). Eligible assets include:

Equipment and machinery

Computers and software

Certain vehicles (including heavy SUVs and trucks over 6,000 lbs GVWR)

Qualified Improvement Property (QIP)

Qualified Production Property (QPP) such as manufacturing facilities (through 2030

deadlines)

Assets purchased before January 19, 2025 and placed in service in 2025 remain limited to 40%

bonus depreciation.

4. Section 179 Expensing

Tip: Section 179 provides an alternative to bonus depreciation, with higher deduction limits

under the OBBBA.

Details: For 2025:

Maximum immediate deduction: $2.5M (up from $1.25M).

Phaseout starts at $4M in eligible asset purchases (up from $3.13M).

Deduction applies to equipment, software, roofs, HVAC systems, security systems, and

more.

Important: Bonus depreciation is usually preferable since Sec. 179 is subject to more limitations

(including at both entity and owner level for pass-throughs).

5. Research & Experimental (R&E) Expenses

Tip: Eligible domestic R&E expenditures can now be deducted immediately.

Details:

Applies to 2025 and beyond.

Businesses may retroactively amend returns for 2022–2024 to accelerate deductions.

Capitalized R&E expenses from prior years can be written off over one or two years

starting in 2025.

6. Qualified Small Business (QSB) Stock

Tip: Funding a new business with QSB stock can offer substantial tax breaks.

Details: The OBBBA:

Raises the asset ceiling for QSBs to $75M (from $50M).

Allows gain exclusions based on holding periods:

o 50% after 3 years

o 75% after 4 years

o 100% after 5 years

These new rules apply to QSB stock issued after July 4, 2025.

7. Retirement Plans

Tip: Tax-favored retirement plans remain a powerful savings tool.

Details: For 2025, self-employed individuals can contribute up to $70,000 via SEP-IRAs or 25%

of salary if incorporated. Other options include defined benefit plans, SIMPLE-IRAs, and solo

401(k)s.

Most plans (except SIMPLE-IRAs) can be set up and funded by the tax return due date,

including extensions.

SIMPLE-IRA plans must be established by October 1, 2025.

8. Clean Energy Incentives

Tip: Many energy-related tax credits are being phased out earlier than expected.

Details: Expiration dates include:

Sept. 30, 2025: Clean commercial vehicle & sustainable aviation fuel credits

June 30, 2026: Refueling credit, energy-efficient buildings deduction, new home credit

Dec. 31, 2026: Clean electricity credits

Dec. 31, 2027: Hydrogen production credit

Act quickly if these incentives are part of your investment plans.

Final Takeaway

The OBBBA delivers long-term certainty and expanded opportunities for small businesses, but

also accelerates the sunset of some incentives. To make the most of these changes, coordinate

with your tax advisor now and develop a tailored strategy that maximizes savings while avoiding

unintended consequences.