For the first half of the year, individual taxpayers faced a lot of uncertainty. Several provisions from the Tax Cuts and Jobs Act of 2017 (TCJA) were set to expire, leaving many wondering how to plan ahead. But with the passage of the One Big Beautiful Bill Act (OBBBA) in July, we finally have clarity. Federal tax rules for individuals are now largely settled—at least for the next few years.

Let’s break down the biggest changes you need to know, plus some practical tax-planning tips for 2025.

Permanent Individual Tax Rates

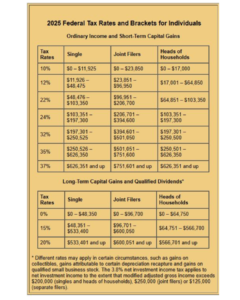

The OBBBA makes the favorable federal income tax rates introduced under the TCJA permanent. That means the seven tax brackets stay in place, with modest annual adjustments for inflation.

Importantly, there are no changes to the tax treatment of long-term capital gains and qualified dividends. These remain taxed at 0%, 15%, or 20%, depending on your income. Certain real estate and collectibles still face higher special rates, and higher-income taxpayers may continue owing the 3.8% net investment income tax (NIIT).

Standard and Itemized Deductions

The higher standard deduction amounts introduced by the TCJA are here to stay—along with a small increase this year:

- $15,750 for single filers

- $23,625 for heads of household

- $31,500 for married couples filing jointly

Additional deductions remain for taxpayers who are 65 or older or blind. For 2025, that means:

- $2,000 for an unmarried filer

- $1,600 for each spouse on a joint return

A New Deduction for Seniors

From 2025 through 2028, seniors age 65 and older can claim an extra deduction of up to $6,000—even if they don’t itemize. Couples where both spouses qualify could deduct up to $12,000.

This deduction phases out starting at $75,000 of income for singles and $150,000 for joint filers, disappearing completely at higher thresholds. Still, for many retirees, this new provision could significantly lower taxable income.

SALT Deduction Expansion

State and local tax (SALT) deductions are also getting a boost. Under the OBBBA, the cap rises to $40,000 ($20,000 for separate filers) from 2025 through 2029, with small annual increases.

However, keep in mind:

- The higher limit phases out for individuals with MAGI over $500,000 (or $250,000 for separate filers).

- In 2030, unless Congress acts again, the cap is set to drop back down to $10,000.

Workarounds remain available for business owners via pass-through entity (PTET) laws, which can shift SALT payments to entities and bypass the cap.

7 Smart Tax-Planning Moves for 2025

With the new rules in place, here are some strategies to consider before year-end:

- Maximize the standard deduction: “Bunch” expenses like mortgage interest, charitable contributions, or medical costs into this year if they’ll push you past the standard deduction threshold.

- Harvest gains and losses: Use losses to offset gains in your taxable accounts. This can reduce your tax bill on appreciated investments.

- Gift appreciated investments: Consider transferring investments to family members in lower tax brackets. This can lower overall capital gains taxes.

- Donate smartly: Contribute appreciated assets (to avoid capital gains tax) or plan charitable giving now, before less favorable deduction rules kick in after 2025.

- Make IRA charitable gifts: If you’re over 70½, you can donate directly from an IRA—reducing your taxable income and MAGI.

- Consider a Roth conversion: With rates locked in, this may be an opportune time to convert traditional IRAs to Roth IRAs, spreading tax liability over multiple years.

- Act on energy credits before they expire: Incentives for clean vehicles, charging stations, and home energy improvements end sooner than previously expected. Don’t wait too long.

Final Thoughts

The OBBBA delivers much-needed stability after years of tax code uncertainty. It also creates new opportunities for taxpayers—especially seniors and those with high state and local tax bills.

The key takeaway? Plan early and strategically. Talk with your tax advisor about which of these moves could help you minimize your 2025 tax liability while setting yourself up for the future.