You may have heard that the Inflation Reduction Act (IRA) was signed into law recently. While experts have varying opinions about whether it will...

cpainomaha

Don’t forget income taxes when planning your estate

As a result of the current estate tax exemption amount ($12.06 million in 2022), many estates no longer need to be concerned with federal estate...

Business Year-End Tax Planning Strategies

Another year is quickly coming to an end. This article is intended to give you some ideas on saving taxes for 2022. However, it is general in nature...

2022 Year-End Tax Strategies for Your Stock Portfolio

When you take advantage of the tax code, your stock market portfolio can represent a little gold mine of opportunities to reduce your 2022 income...

Inflation Reduction Act provisions of interest to small businesses

The Inflation Reduction Act (IRA), signed into law by President Biden on August 16, contains many provisions related to climate, energy and taxes....

Home sweet home: Do you qualify for office deductions?

If you’re a business owner working from home or an entrepreneur with a home-based side gig, you may qualify for valuable home office deductions. But...

Self-employed? Build a nest egg with a solo 401(k) plan

Do you own a successful small business with no employees and want to set up a retirement plan? Or do you want to upgrade from a SIMPLE IRA or...

An “innocent spouse” may be able to escape tax liability

When a married couple files a joint tax return, each spouse is “jointly and severally” liable for the full amount of tax on the couple’s combined...

Why an LLC might be the best choice of entity for your business

The business entity you choose can affect your taxes, your personal liability and other issues. A limited liability company (LLC) is somewhat of a...

Estimated tax payments: Who owes them and when is the next one due?

If you don’t have enough federal tax withheld from your paychecks and other payments, you may have to make estimated tax payments. This is the case...

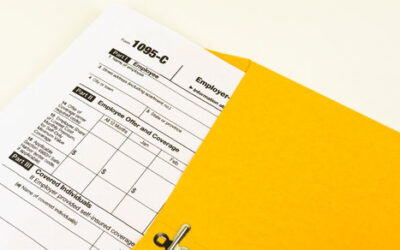

Is your business required to report employee health coverage?

As you’re aware, certain employers are required to report information related to their employees’ health coverage. Does your business have to...

How to avoid the early withdrawal tax penalty on IRA distributions

When you take withdrawals from your traditional IRA, you probably know that they’re taxable. But there may be a penalty tax on early withdrawals...

How to treat business website costs for tax purposes

These days, most businesses have websites. But surprisingly, the IRS hasn’t issued formal guidance on when website costs can be deducted....

Is your withholding adequate? Here’s how to check

When you filed your federal tax return this year, were you surprised to find you owed money? You might want to change your withholding so that this...

Three tax breaks for small businesses

Sometimes, bigger isn’t better: Your small- or medium-sized business may be eligible for some tax breaks that aren’t available to larger businesses....

Have a Question You Need Answered?

Schedule an Appointment Today!